THE VIOLENT BIRTH OF CORPORATIONS

Why did 17th-century Europeans create the world’s first corporations? Looking back, the answer seems obvious: The corporation seems like such a logical way to do business, especially on a big scale, that the wonder is that they weren’t invented sooner. But the real answer turns out to be more complicated and only loosely related to the advantages of the corporate form today.

The first real corporations—the Dutch and English East India Companies, West India Companies, and so on—were hardly the first big business partnerships, but they were new in several ways. They were anonymous; the partners did not all have to know each other. They separated ownership from control: Elected directors made decisions while most investors had only the choice of accepting those decisions or selling their shares. They were permanent: If one or more partners did want out, there was no need to renegotiate the whole arrangement. Finally, they were legal entities separate from any one owner, and they had unlimited life. The big trading partnerships of the 16th century and earlier were created with a planned date of dissolution—sometimes at the end of one voyage, sometimes after a set number of years—at which point all the firm’s holdings would be liquidated and divided among the partners. The new firms, like modern corporations, did not self-liquidate: They built up their capital over the years rather than distributing it back to its separate owners.

Clever innovations, to be sure—but how many people at the time needed them? Very few. Over the next 200 years, almost no corporations were created for either manufacturing or intra-European trade. The capital needs of virtually all production at this time were small enough that people could raise the funds they needed without taking the risks of dealing with strangers. Even the new mass-production factories of the industrial revolution—Wedgwood china, Schneider (Le Creusot) iron and virtually all the English cotton mills—were family firms, as were the coal-mining companies that fueled the new economy (turnpike and canal building were partial exceptions). Not until the post-1830 railway boom was there finally an industry that required so much capital, and so long a wait before the profits started to roll in, that the corporate form was really essential.

Where lots of patient capital was needed, even in the 1600s, was for economic activities that ranged beyond Europe. A round trip voyage to East Asia could take three years to complete, and if a partnership wished to spread its risks over several voyages, the partners would have to wait still longer for the final payout. But even this did not require that the corporation have permanent life: The English Muscovy Co., which traded with Russia, for instance, did not have this feature. Moreover, there was considerable resistance to the idea among investors; with share markets not yet fully developed, they didn’t know if they’d ever get their principal back unless the company had to dissolve at a certain date. Partly as a result, the Dutch East India Co. was originally chartered with a long but finite life—it was to be liquidated in 21 years—and with compulsory high dividends. And Asian merchants who handled trade over distances almost as long—and who often continued to outcompete the Europeans on routes between the Middle East, India, Southeast Asia, Japan and China all the way through the 18th century—apparently had no need of the corporate form.

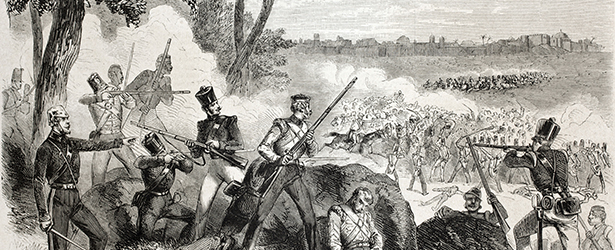

So what made the turn to permanent life necessary? In a word, violence. The East India Companies were not just licensed to trade but to make war on the Portuguese, who had created fortified colonies and used their navy to claim a monopoly on trade from Asia; the West India Companies faced similar Spanish and Portuguese claims (and much stronger colonies) in the Americas. To compete, the Northern Europeans reasoned, they would need to play the same game: seizing and fortifying territory and arming ships to patrol the waters. But this meant enormous costs for fixed capital in forts and ships, and for working capital, such as provisions. (Asian traders largely refused to play this game, concentrating on the vast stretches of the ocean and coast where the Europeans could not enforce their monopolies. As a result, they had far lower overhead and could consistently undersell the Europeans wherever force could not create monopolies, which meant almost everywhere besides a few strategic straits.) In the New World, distances were shorter, but other problems were more demanding. Unlike fortified European bases in Asia, which could buy supplies and hire laborers from highly commercialized neighboring societies, New World bases needed to be much more self-sufficient, and so had to be real colonies with productive agriculture—something that took much longer to create.

Because they needed so much capital to fend each other off, Europe’s overseas ventures could not possibly be organized without bringing in many unrelated partners. And because they needed so much fixed capital, only a very large trading volume would generate enough profit to make these ventures worthwhile. And a very large trading volume, in turn, meant that very large amounts of working capital had to be tied up in inventories held overseas, awaiting the right moment to exchange them for goods that would sell back in Europe. Indeed, the founder of the Dutch East India Co.’s empire in Asia, Jan Pieterszon Coen, waged an almost constant battle with Amsterdam for more capital. The European directors kept suggesting that, having achieved naval superiority, he could monopolize the spice trade back to Europe without much more capital by raiding; he replied that he could indeed do so, but that raiding discouraged trade, and so would never yield a large enough volume to cover costs, even if he did achieve monopoly. To make the forts pay off, whole new lines of trade needed to be developed and others greatly expanded—and that meant more capital and more patience. After years of conflict, and many revolts by shareholders who wanted the company to wind down rather than grow, Coen and his successors won: The company was re-chartered rather than liquidated after 21 years, the directors got the flexibility to lower dividends when they needed to build up capital, and Dutch investors learned to operate like shareholders today.

The idea of companies that took care of their own protection costs did not last, of course. As the costs of war-making soared in the 18th century, both the English and Dutch companies staggered under the burden; when they tried to make back these costs on goods they monopolized, they found themselves very unpopular and often undercut by smugglers. (The English East India Co.’s problems with tea sales in America are only the most famous example.) By the 1830s, all these companies had collapsed, and their colonies had been taken over by governments—just as a new era of capital-intensive industry was about to create more productive uses for the corporate form that they had pioneered.

Leave a Reply