Full Speed Ahead

Riding the waves of a $573 million 2010 positive trade balance in U.S. recreational boats, the venerable Chris-Craft moniker now graces a line of redesigned luxury speed boats, perfect for jet setters in the U.S. and abroad. Like other heritage brands, those classic out-of-favor product lines that instill profound loyalties and deep resonance in consumers’ psyches, Chris-Craft has risen from the boneyard of broken brands, thanks to the business acumen of its current owners and the global appeal of its vessels. Of the roughly 600 boats it produces annually, approximately 25 percent grace sparkling lakes and seas outside the U.S.

According to Steve Callahan, Chris-Craft’s vice president of materials, Sweden, the Czech Republic, Turkey and Australia are the firm’s top export markets. The Balkans, Singapore, New Zealand, Hong Kong and Brazil are bright spots, with France, South Africa and Spain coming on strong. Reaching the high net worth yachtsman involves deft dealer leadership, word of mouth, reputation and the simple act of a potential buyer seeing a Chris-Craft boat aboard another ship. Resurrecting a fallen brand? That takes a measure of grit.

Following their practice of picking through legendary brands that suffered through forgettable years to find a gem or two, the owners of the risen boat maker, Stellican Ltd’s chairman Stephen Julius and chief executive officer Stephen Heese, have found a niche in an industry that evokes upscale leisure wrapped in the all-American red, white and blue spirit of innovation. Working their magic of capital infusion, high craftsmanship and premium prices, the duo court the ultra rich who can plunk down $225,000 on a tender—a small boat towed or carried by a yacht for short jaunts or going ashore when the yacht is anchored.

A Blast From The Past

Understanding how a speed boat like Chris-Craft’s Corsair 36 European edition belongs on a mega yacht requires a peek at the boat maker’s storied history and an appreciation of how two Harvard Business School grads, Julius and Heese, had the finesse to make it happen. Julius formed Stellican Ltd as a private equity firm in 1991, primarily to mind his family’s money but also to acquire and fix out-of-favor iconic brands. Heese joined his former classmate in 2001 to captain the Chris-Craft turnaround after selling his stake in a global construction products company. Through the partnership, Julius has provided working capital and an artist’s aesthetic; Heese adds an accountant’s analytical scrutiny and manufacturing muscle. Simply put, their partnership involves the ABCs of business turnarounds: Acquire an authentic brand, Burnish it, and Cadge a tidy profit, hopefully north of 35 percent.

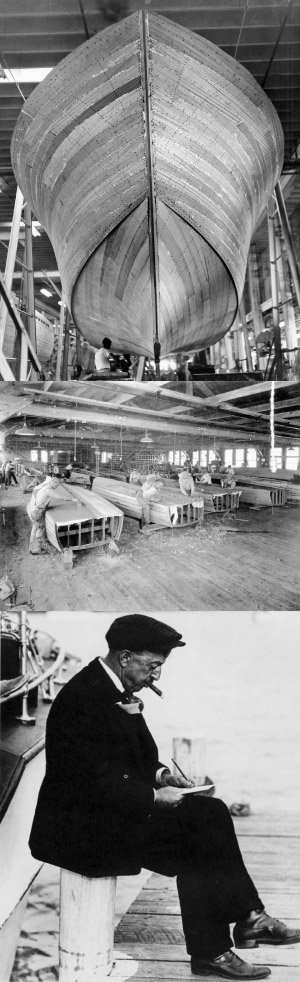

(middle) Founder christopher columbus smith had established a reputation as a great boat maker by the 1890s.

The two partners tested their sea legs before the Christ-Craft adventure. Julius had acquired and successfully turned around Riva, the beleaguered, upscale Italian marine titan, in 1998. Heese, with global business experience, is a lifelong sailor who grew up a shell’s throw from Chris-Craft’s manufacturing facility near Sarasota, Florida.

The Riva saga was a template for the Chris-Craft deal. In it, la famiglia Riva ceded control of the business to outsiders in 1969, subsequently changing hands several times until Rolls-Royce took over. After losing boatloads of money on Riva, the British automaker unloaded it on Stellican in a quickie deal. Julius revived Riva with a redesigned line of boats that evoked in customers la dolce vita’s vibe of the 1960s Riva Aquarama runabout. The ABC formula worked. Ferretti Yachts, Italy’s largest yacht maker, acquired Riva from Stellican Ltd in 2000.

That transaction prepared Stellican for Chris-Craft’s complicated rescue from bankruptcy in 2001, which involved acquiring the trademark and an inventory of 130 finished and unfinished boats in separate transactions. Stellican Ltd reportedly paid $5 million each for the brand name and the assets. “Chris-Craft was a fantastic brand with decades of forgettable years, plus it met our skill sets,” Heese says.

Chris-Craft’s rise and fall follows the story line of a great brand gone south. In 1874, 13-year-old Christopher Columbus Smith built a fast and durable skiff for duck hunting on Michigan’s Lake St. Clair. Other Great Lakes boaters liked his swift, sturdy runabouts and his reputation was established by the 1890s, burnished later by five straight Gold Cup speedboat racing victories. For the next seven decades, Chris-Craft’s scrupulously detailed boats, with their mahogany and brass fixtures and racing heritage, drew celebrities, racers and pleasure boaters until the 1960s, when fiberglass boats and other innovations caught customers’ eyes and stole market share. Chris-Craft sales sank. Eleven straight years of losses put the company at low ebb in the late 1990s.

What the firm threw overboard during those lost decades is what made its boats great—the classic mahogany and brass that looked so good skimming turquoise lake waters. David Hutson, now 69 and a lifelong boater, recounts what made the vintage Chris-Craft speedboats special. “I was working in Chicago for the summer in 1962 when I was 19,” he says. “Someone asked me if I wanted to go waterskiing. He had a 26-foot mahogany hulled Chris-Craft that went flying through the water. The experience was so beautiful and I felt invincible.”

The Chris-Craft magic that made for a penultimate U.S. lake boat has now been extended to a brand with global reach. “Our sweet spot is a 24- to 26-foot boat for the owner here or overseas who will spend $225,000 on a Chris-Craft rather than $120,000 for an ordinary boat of the same size,” says Heese.

Chris-Craft Overseas

Chris-Craft’s global product line, exemplified by the Corsair 36 European edition, adds features that appeal to customers outside North America. They include extended teak or mahogany panels, large windshields, oversized sunbathing platforms, wet bars and customized color schemes. “Europeans prefer a larger sun pad and a smaller cockpit than Americans, who like large areas to entertain friends on their boats,” Heese explains.

There are other nice features. Any first mate who has struggled converting the dining table to a storage or sleeping area would give his yachtsman’s flag for the Corsair’s electric table that rises from the floor to cocktail or dining height at the push of a button. When boaters are finished using the table it lowers electronically into the floor. Other upscale boats may have this feature, but Chris-Craft’s combination of design, materials and performance takes aim at the cognoscenti’s hearts and wallets. Customizing a boat for exacting buyers requires a balancing act between not disrupting factory production in Florida, yet having the flexibility of adding a second refrigerator, fold-down windshield or making a silver-metallic finish for an overseas buyer.

Chris-Craft’s challenge of designing and producing great boats is coupled with finding a smart way to sell those vessels to affluent boaters who have a smorgasbord of spectacular boats from which to choose. To that end, the company’s top guns have built a nexus of 80 dealers worldwide by networking at major boat shows and knocking on doors of well-known dealers in prime boating locations. While each dealer adapts its sales approach to local tastes, common ingredients make a heady mix.

Dealerships at upscale locations such as South Africa’s Broderick Marine at the Riviera-on-Vaal Hotel, Australia’s Premier Marine on Rose Bay or France’s Proyachting at chic Evian les bains beckon the wealthy. Photos of sunbathing babes on deck, images of Chris-Craft boats skimming turquoise seas and the promise of exquisite service sure don’t hurt the sale. To seal the deal, potential buyers get to see and touch the boats. “We encourage dealers to buy three or four boats for display in their showrooms,” says Heese. The dealers’ desire for potential customers to be hands-on with Chris-Craft boats translates to locating nearby destinations where boaters spend the most time on the water, the better to service persnickety clients and their expensive toys. Additionally, Julius and Heese invite all dealers to Chris-Craft headquarters once a year for an intense three-day meeting. New models are introduced, new designs discussed, focus groups are held to discuss customer wants and exporting and marketing strategies are bandied about.

Once a boat is sold and ready to leave the factory, the materials team steps in to prepare it for travel to Chris-Craft’s far-flung dealers. “All loose items inside the boat such as mattresses, cushions and covers are either stowed in storage areas or packaged with strapping tape,” says Steve Callahan. “There’s also foam packing on the windshield and other protruding components. We then put a transhield, which is a transport cover that is heated and then fitted to the boat’s contours, to prevent ‘road rash’ caused by rocks and dirt hitting the boat.” Nestled in a cradle, the boat is then loaded on a transport trailer for delivery to one of four U.S. ports: Jacksonville or Miami, Florida, or Savannah or Brunswick, Georgia. The boat, strapped to its transport cradle, is then hoisted on the ocean freighter.

Chris-Craft’s freight-forwarder, Peters & May, global boat transporters headquartered in the U.K., then handles the details of shipping the boat overseas. Through its Chicago office, the marine logistics experts prepare necessary documents including a dock receipt, booking confirmations, bill of lading and customs documentation. Vital pieces of data include the freight originator, U.S. port and terminal location and phone numbers, trucker information, ports of departure and discharge, dates of shipment and arrival, bill of lading reference numbers and the hull ID. Peters & May also ensures that the shipment adheres to the destination country’s regulations. For example, Australia requires that the transport cradle be fumigated.

On the Horizon

Like other exporters of big ticket items, Chris-Craft has experienced turbulence caused by 2008’s global financial meltdown. The company turned a profit in 2002 on revenues of $30 million, jumped to $50 million in 2006 and to $60 million in 2008. Buyers for the company came courting until the global economy “entered a death spiral,” as Heese puts it. Revenues dropped to $30 million in 2010 but rebounded to $40 million in 2011, still short of Stellican’s profit target. The partners continue to have high hopes for their aspirational brand, and that strong demand for U.S. marine products overseas (see sidebar) will help them eventually reach their ROI goal.

Unlike its two successful executions of the ABC strategy—Riva’s two-year turnaround and the resurgence of Indian Motorcycles in less than five years—Chris-Craft is a long-term labor of love. Part of that decision goes beyond professional to personal. Heese, who grew up and sailed the waters of his native Florida, is happy to have returned home with his family to co-pilot a line of boats with an extraordinary lineage.

Leave a Reply