U.S. East and Gulf Coast Port Strike Commences without Contract Agreement in Sight

On October 1 at 12:01 local time, approximately 45,000 dockworkers launched a strike at U.S. east and gulf coast ports. The workers are represented by the International Longshoremen’s Association (ILA) while the 36 major ports impacted by the strike are represented by the United States Maritime Alliance (USMX). Ports from Maine to Texas are impacted by the coordinated strike action, including New York-New Jersey, Savannah, Charleston, Houston, and Mobile, among others. While negotiations on a new collective bargaining agreement began earlier this year, talks between the ILA and the USMX soured this summer over differing views on future uses of automation in port operations and worker wage increases.

Read also: U.S. East Coast Dockworkers’ Strike – Key Insights for Container Traders and Leasing Companies

The ILA has demanded that the new contract agreement explicitly protects the future of dockworker’s jobs through continued restrictions on the use of automation. This issue has been contested throughout the negotiation process, with a key point of argument from the ILA being the automatic gates installed at a terminal in the Port of Mobile. The union has also demanded that the new deal include a pay increase for workers of roughly 75-77% over the life of the new six-year contract. Initial offers from the USMX were well below this increase, which stalled negotiations throughout the summer months and led to an impasse in discussions. The USMX made one final offer on September 30 which reportedly included a 50% pay increase for workers, but the union promptly rejected it and commenced the strike action.

Different strike scenarios remain possible moving forward

Throughout the negotiation process, it was uncertain which strike measure the union would take if a new contract agreement could not be reached. On October 1, the decision to launch a full-scale strike at the union-represented ports marks a departure from the disruptions at U.S. west coast ports in 2022-2023. Although the contract expired for west coast ports in a similar way, the International Longshore and Warehouse Union (ILWU) never launched full-scale strike action and instead used a series of informal pickets, spontaneous union meetings, and overtime limitations. While operational disruptions and cargo processing delays occurred, U.S. west coast ports remained open throughout the negotiations which minimized the supply chain impacts.

Contrastingly, full-scale strikes are set to take place on both the east and gulf coasts until a new contract agreement is reached. There is a possibility that pressure from the White House or business groups could force the port workers to consider a work-to-rule order with only partial disruptions, but this option has not yet been publicly discussed. Carriers are likely to continue their “wait and see” approach at anchorage outside affected ports unless the strike persists longer than one week. In that case, it is possible that growing cargo delivery delays may prompt non-time-sensitive shipments toward lengthy diversions for processing and onward transit from other ports. Time-sensitive goods may be temporarily shipped by air given limited buffer stocks. If the strike lasts beyond two weeks, diversions of general goods to other ports and ocean to air freight conversions of sensitive goods are both likely to occur on a large scale, and for the foreseeable future, to ensure domestic supplies for U.S. consumers and healthcare patients.

| SCENARIOS | OUTLOOK | STRATEGIES |

|

“WAIT AND SEE” APPROACH |

Carriers continue to queue at designated anchorage points outside affected ports in hopes of a prompt strike resolution; largescale diversions do not occur | Except for perishable and other time-sensitive goods, vessels carrying general consumer items should anchor outside of their original destination port; time-sensitive sectors should consider switching to air freight temporarily |

| FULL-SCALE STRIKE FOR 1+ WEEK | Growing cargo delivery delays due to halted receiving and handling operations; operational backlog likely to last into late November/early December | Consider diverting non-perishable and non-time-sensitive shipments through the Panama Canal to U.S. west coast ports; time-sensitive sectors should consider switching to air freight in the medium-term |

|

FULL-SCALE STRIKE FOR 2+ WEEKS |

Impacts on all trade routes with severe cargo delivery delays and processing backlogs likely to last beyond the end of the year; disrupted shipping schedules and container imbalances add to prolonged impacts | All shipments should consider diverting to alternative ports on the U.S. west coast, or in Canada or Mexico where most sensible given end-market destination; time-sensitive goods should shift to air freight for foreseeable future to ensure continuity |

Figure 1: Table of scenarios for the development of strike action (source: Everstream Analytics).

U.S. government unlikely to intervene in strike negotiations despite pressure

Many business groups have called for President Biden to intervene in the negotiations and force the two parties to come to an agreement through mediation efforts. Under the Taft-Harley Act, the U.S. president has the authority to order port workers to return to their jobs if the strike presents a threat to national security. In response to this pressure, President Biden has explicitly stated that he does not intend to invoke Taft-Hartley or see intervention as a viable step forward. He has instead called for the two sides to continue in collective bargaining but remains pro-union in his stance that USMX should increase the wage offer for workers given the high profitability of ports in the last several years.

Given the election season, it remains unlikely that the government will intervene, and risk being seen as anti-union. However, the administration also risks a loss in confidence from voters if the strike continues and damages the U.S. economy, the latter being a consistent a key voting issue in most U.S. elections. Given the government’s strong economic incentive to see the talks come to a speedy resolution, the White House is most likely to follow the approach that it used during the 2022-2023 U.S. west coast negotiations. In 2023, President Biden sent Department of Labor Secretary Julie Su to the negotiating table to help finalize a deal with an objective, amicable approach. Should this tactic be employed again, prospects of an early cessation of strike activity, or at the very least a reduction in the full-scale nature of the strike, could occur.

Outlook and recommendations

Large-scale diversions to other U.S. ports on the west coast or other ports in Canada, Mexico, or the Bahamas, have not yet taken shape. Many vessels may be employing a wait-and-see approach, hoping for a prompt resolution to the strike action, rather than diverting and absorbing the guaranteed additional shipping costs and time that come with that decision. Others may be deterred by the limited diversion options, given the limited booking spots available through the Panama Canal, the concurrent port strike in Montreal, Canada, or the offhand mentions of a potential solidarity strike by U.S. west coast port workers. Though there are no concrete plans for the latter, just the possibility could make shippers hesitant to risk adding the diversion time and still be faced with limited port capacity upon arrival elsewhere.

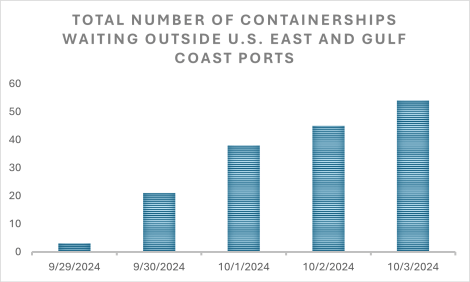

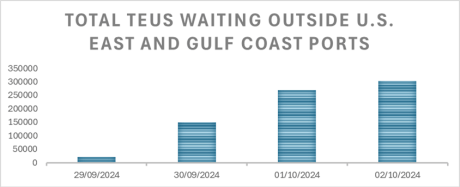

The most likely scenario in the short-term is that vessel queues outside of affected U.S. east coast and gulf coast ports continue to increase. The total number of containerships anchored outside of the affected ports has reached 54, up from 45 the day prior, and 38 two days prior on the first day of the strike. Currently, there are over 300,000 twenty foot-equivalent units (TEUs) being carried on the queued vessels, a stark 50% increase from the day before the strike began. Given this trajectory, if the strike lasts even one week, the number of waiting container vessels could easily exceed 100 with the number of halted TEUs rising in unison. The most affected ports are currently the port of Savannah (15 vessels), Georgia, Norfolk, Virginia (8 vessels), and New York (14 vessels). For every 24 hours of disrupted port operations, a roughly 7-day operational backlog can be expected due to the time required to process the built-up containers that will all demand immediate unloading and processing for onward transit.

If the strike extends beyond one week, it is also possible that some vessels carrying general retail goods may consider lengthy diversions as their best option. If this becomes a trend, congestion at alternative ports may begin to increase, and misplaced containers and disrupted shipping schedules may prolong the subsequent backlogs even beyond that 7-day projected timeframe. Shippers with time-sensitive goods like perishable foods and pharmaceuticals are more likely to convert to air freight as a more viable option to ensure timely deliveries of critical shipments without risking the spoilage and cargo loss that would accompany long anchorage waits or diversion schedules. Some specialized cargo like automotive components may also opt for an ocean-to-air conversion as this sector has limited inventory stockpiled due to just-in-time manufacturing practices meant to avoid profit losses from unsold product. In these cases, cargo backlogs would be avoided but increased costs would be incurred as air freight is priced roughly 16 times higher than ocean freight due to its safety, timeliness, and reliability. Air freight capacity pressures from the increased demand may prompt an even larger freight rate gap.

Though estimates about the strike’s duration are mostly speculative at this point, this will be the biggest factor in determining the scale of impact on supply chains and the U.S. economy more broadly due to depleting buffer stocks. Other factors, like whether the union maintains its stance on a full-scale strike action versus employing a limited work-to-rule order, and if the west coast port workers’ union declares solidarity strikes, will also dictate the level of impact. Without a pledge for government intervention or mediation in negotiations, the idea of a forced cessation of strike activity remains unlikely for the time being. Considering the upcoming U.S. presidential election, it is expected that the federal stance on the strikes will remain pro-union while delicately championing a swift end to the disruptions. Therefore, the only resolution will be through negotiation, which have been largely concealed from the public.

Leave a Reply