The Bear is Back: A Global Pandemic

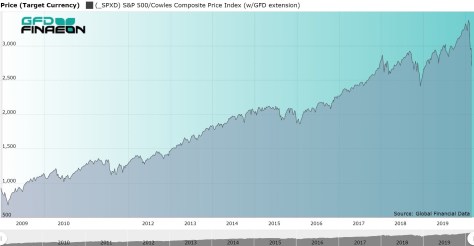

The U.S. stock market fell into a bear market on March 12, 2020, ending the bull market that began in 2009. The bull market had begun on March 9, 2009, and peaked on February 19, 2020. The S&P 500 rose 400% between 2009 and 2020, the Dow Jones Industrials rose 351% between 2009 and 2020 and the NASDAQ Composite rose 674% between 2009 and 2020. However, since February 19, 2020, we have seen dramatic declines in all three.

Figure 1. S&P 500, 2009 to 2020

The GFD US-100 Index provides coverage beginning in 1792. By our calculation, there have been twenty-four bull and bear markets since 1792 with four occurring in the 1800s, seventeen in the 1900s, and three in the 2000s. The worst bear market was in 1929-1932, led by an 89% decline in the Dow Jones Industrials. Two prior bear markets in this century both had declines of 50% in 2000-2002 and 2007-2009. By comparison, previous bear markets, such as those occurring in 1987 and 1990, only lasted a few months before a bounce-back.

What is interesting about this current bear is how quickly and how sharply it hit markets throughout the world in response to the spread of the Coronavirus. This was a quick, simultaneous financial pandemic in every nation of the world. In many countries, the 2020 bear market is simply a continuation of the bear market that began in 2018.

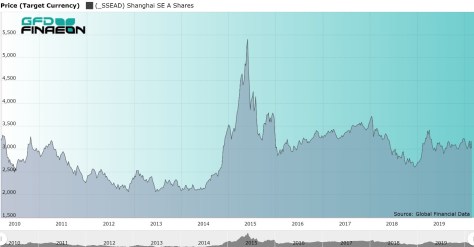

The extent of the bear market in 22 countries and for global indices is provided in Table 1 which uses data from the GFDatabase. The table shows the date of the market top, the value the index hit on that date, the change from the previous market low, the current value of the market, and how much each market has fallen since the top in 2018 or 2020. The only major market in the world which has not fallen into a bear market this year is the Chinese market, the country where the coronavirus originated. However, the Chinese market had already been in a state of decline since 2015.

Figure 2. Shanghai Stock Exchange “A” Shares Index, 2010 to 2020

So far, global markets have fallen by around 30-40%. The question is, how much more are the markets likely to fall? Will this be a short-lived bear market as occurred in 1987 and 1990 or a more extended bear market as occurred in 2000-2002 and 2007-2009?

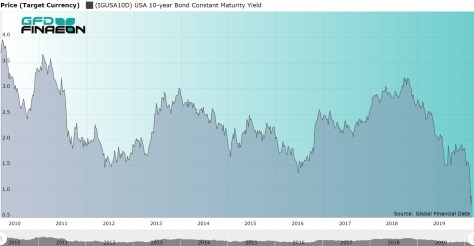

Figure 3. United States 10-year Bond Yield, 2010 to 2020

It should be noted that fixed-income markets have already hit their bottom in the United States. This occurred on March 9 when the 10-year bond fell below 0.5% as we had previously predicted in the blog “230 Years of Data Show Rates Will Soon Hit 0.50%.” Yields have slightly risen since then. Moreover, the Shanghai Index bottomed out on February 3, 2020, when the stock market reopened after the Chinese New Year and has not participated in the worldwide sell-off. Both of these indicate that this bear market will not continue for an extended period of time. We will update Table 1 on a regular basis so our readers can follow the changes in this COVID bear market.

Table 1. COVID Bear Market Statistics for 22 Countries and 4 Regions

Country |

Index |

Market Top |

Value |

Change |

Market Low |

Value |

Change |

| Asia | |||||||

| Australia | All-Ordinaries | 2/20/2020 | 7255.2 | 133.16 | 3/23/2020 | 4564.1 | -37.09 |

| China | Shanghai A Shares | 6/12/2015 | 5410.86 | 165.15 | 12/27/2018 | 2600.05 | -51.95 |

| Hong Kong | Hang Seng | 1/26/2018 | 33154.12 | 80.98 | 3/23/2020 | 21696.13 | -32.76 |

| India | BSE Sensex | 1/14/2020 | 41952.63 | 82.79 | 3/23/2020 | 25981.24 | -38.07 |

| Japan | TOPIX | 1/23/2018 | 1911.31 | 59.77 | 3/16/2020 | 1236.34 | -35.31 |

| Singapore | FTSE ST All-Share | 1/24/2018 | 877.87 | 40.38 | 3/23/2020 | 540.6 | -38.42 |

| South Korea | Korea SE Price Index | 1/29/2018 | 2598.19 | 57.21 | 3/19/2020 | 1457.64 | -43.90 |

| Taiwan | Taiwan Weighted | 1/14/2020 | 12179.81 | 56.41 | 3/19/2020 | 8681.34 | -28.72 |

| Europe and Africa | |||||||

| Belgium | All-Share | 4/13/2015 | 13859.94 | 104.31 | 3/18/2020 | 7202.21 | -48.04 |

| France | CAC All-Tradable | 2/12/2020 | 4732.14 | 56.27 | 3/18/2020 | 2888.89 | -38.95 |

| Germany | CDAX Composite | 1/23/2018 | 625.19 | 50.07 | 3/18/2020 | 363.83 | -41.80 |

| Italy | FTSE Italia All-Share | 2/19/2020 | 27675.06 | 39.43 | 3/12/2020 | 16286.37 | -41.15 |

| Netherlands | All-Share Index | 2/12/2020 | 904.31 | 54.15 | 3/18/2020 | 574.88 | -36.43 |

| Norway | OBX Price | 9/25/2018 | 523.06 | 70.44 | 3/16/2020 | 329.67 | -36.92 |

| South Africa | FTSE All-Share | 1/25/2018 | 61684.8 | 246.26 | 3/19/2020 | 37963 | -38.46 |

| Spain | Madrid General | 4/13/2015 | 1203.82 | 99.78 | 3/16/2020 | 608.26 | -49.47 |

| Sweden | OMX All-Share Price | 2/19/2020 | 732.67 | 68.35 | 3/23/2020 | 478.95 | -34.63 |

| Switzerland | SPI Price Index | 2/19/2020 | 731.04 | 140.71 | 3/16/2020 | 548.52 | -24.97 |

| United Kingdom | FTSE-100 | 5/22/2018 | 7534.4 | 99.27 | 3/23/2020 | 4993.89 | -33.72 |

| Americas | |||||||

| Brazil | Bovespa | 1/23/2020 | 119528 | 217.51 | 3/23/2020 | 63451.55 | -46.91 |

| Canada | TSE-300 | 2/20/2020 | 17944.1 | 51.52 | 3/23/2020 | 11228.49 | -37.43 |

| Mexico | Mexico IPC | 7/25/2017 | 51713.38 | 206.16 | 3/23/2020 | 32936.6 | -36.31 |

| United States | DJIA | 2/12/2020 | 29551.42 | 351.37 | 3/23/2020 | 18576.04 | -37.14 |

| United States | S&P 500 | 2/19/2020 | 3386.15 | 400.52 | 3/23/2020 | 2236.7 | -33.95 |

| United States | NASDAQ | 2/19/2020 | 9817.18 | 58.52 | 3/23/2020 | 6860.67 | -30.12 |

| Global | |||||||

| Emerging Markets | MSCI Emerging Free | 1/29/2018 | 1278.53 | 85.69 | 3/23/2020 | 758.204 | -40.7 |

| Europe | MSCI Europe | 1/25/2018 | 1926.57 | 47.52 | 3/23/2020 | 1152.698 | -40.16 |

| World | MSCI World | 2/12/2020 | 2434.95 | 35.63 | 3/23/2020 | 1602.105 | -34.2 |

| World | MSCI EAFE | 1/25/2018 | 2186.65 | 46.52 | 3/23/2020 | 1354.3 | -38.07 |

___________________________________________________________

Dr. Bryan Taylor is President and Chief Economist for Global Financial Data. He received his Ph.D. from Claremont Graduate University in Economics writing about the economics of the arts. He has taught both economics and finance at numerous universities in southern California and in Switzerland. He began putting together the Global Financial Database in 1990, collecting and transcribing financial and economic data from historical archives around the world. Dr. Taylor has published numerous articles and blogs based upon the Global Financial Database, the US Stocks and the GFD Indices. Dr. Taylor’s research has uncovered previously unknown aspects of financial history. He has written two books on financial history.

Leave a Reply