Steady Demand for US-bound Shipments keeps Container Prices from Crashing

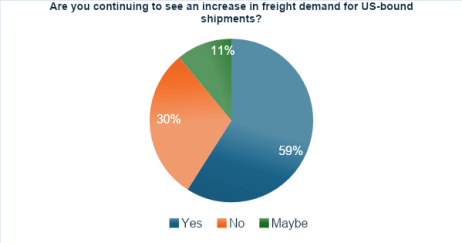

The global container shipping industry continues to witness an increase in freight demand for US bound shipments as 59% of supply chain professionals surveyed in August 2024 respond in affirmation, while 30% of respondents indicated they have not observed a continued rise in demand, and 11% remain uncertain about the trend. This also explains the continued upward pressure on container prices in US and above average level container leasing rates from China to US.

“As we look ahead, the key question remains: How will freight rates and container prices evolve over the next 3 to 6 months? On the one hand, several factors could keep rates elevated or at least stable. Ongoing disruptions in the Red Sea, for example, continue to absorb capacity, with no clear resolution in sight. Additionally, labour disputes at Canadian railroads and U.S. East Coast terminals are causing delays in container turnaround times. This means containers are spending more time in transit, requiring more containers to handle the same amount of freight, which supports higher rates.” Shared Christian Roeloffs, cofounder and CEO of Container xChange.

Read also: US Container Shipping Braces for Headwinds as Peak Season Approaches

“Furthermore, we anticipate a soft landing for the U.S. economy, which should sustain healthy demand for containerized imports. If carriers maintain pricing discipline, we could see rates remain strong in the near term.”

“However, there are strong arguments for rates to decline in the coming months. 2024 is on track to become the second-highest year for container deliveries, with manufacturers booked solid through October. The year is shaping up to be one of the strongest years for container production on record. As the same is true for new vessel deliveries, these capacity injections could lead to oversupply despite ongoing disruptions. There’s also uncertainty around the U.S. economy, with pressure on the Fed to cut interest rates at a relatively fast pace due to looming challenges in the labour market. If the economy slows, we may not see the continued demand growth needed to support current freight rates.”

“Moreover, new entrants on trans-Pacific routes, such as TS Line, SeaLead Shipping, and others, are already putting pressure on established carriers by undercutting rates. This could trigger a price war, which may extend to other trade lanes, putting further downward pressure on rates.”

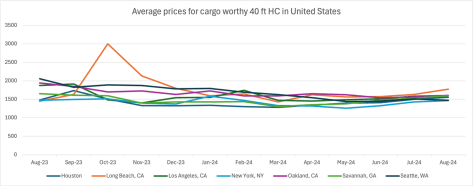

Average container prices continue to grow in the US; majority of respondents from the US expect more price hikes

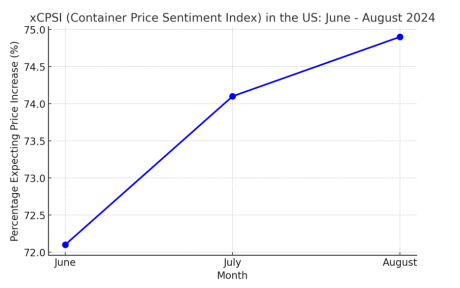

The container price sentiment for the United States has been transitioning from negative to positive which also shows that the sentiment of supply chain professionals from the US has been improving about near-term container price rise.

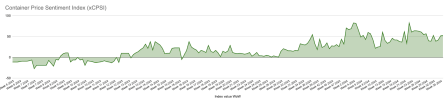

Here is the chart showing the xCPSI (Container Price Sentiment Index) in the US from June to August 2024. The chart illustrates the percentage of supply chain professionals who expected container prices to increase during this period, highlighting a consistent upward sentiment.

Since May 2024, average container prices have shown a modest yet consistent upward trend, rising from $1468 in June to $1534 in July, and reaching $1582 in August. While the growth has not been dramatic, the steady increase indicates ongoing upward pressure on prices.

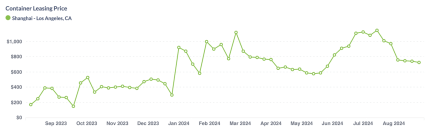

Demand for US bound shipments keep one-way container leasing rates from crashing in August

Strong demand for U.S.-bound shipments have helped keep one-way container leasing rates steady towards the end of August. Average one-way container leasing rates dropped by 40.8%, from $1,436 in July to $850 in August. However, when compared to previous months, rates remain above the lows seen in April and May, where they dipped to the below $600 mark.

Despite this weakening, market sentiment remains optimistic, with many expecting price increases.

The global Container Price Sentiment Index (xCPSI) peaked at 83 in May, reflecting strong optimism for rising container prices. However, by mid-August, the index had moderated to around 39. Each week, we survey supply chain professionals on their expectations for future container prices, and from this data, we compute and index the sentiment to generate our Container Price Sentiment Index (xCPSI).”

Miami-based Andres Valencia, CEO of E-Containers, provides a firsthand perspective on the price stability, growth trends, and the complexities of market fluctuations in the Americas market.

“The ongoing strikes in Canada have introduced complexities in container logistics, particularly in terms of one-way shipments, with certain ports nearing shortages. As some regions see a brief spike in prices due to these disruptions, the overall market remains volatile. Some areas are likely to experience price increases, while others may see a decrease. Looking ahead, we anticipate continued fluctuations in demand across different states, but overall, the market appears resilient as we head into September.”

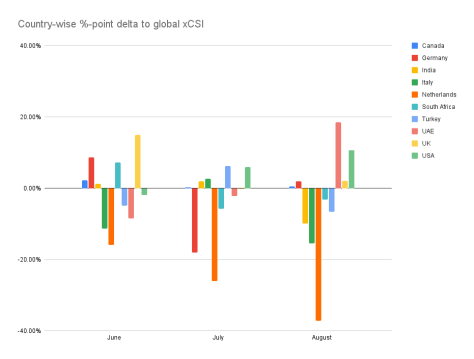

Another significant improvement in the sentiment has come from UAE where the percentage delta as compared to the global sentiment improved from –8% in June to +18% in August.

On the other hand, the container price sentiment has been shifting from positive to negative in India, indicating that more professionals are now expecting container prices to erode in the coming weeks.

Market Outlook

Christian Roeloffs, CEO of Container xChange, highlighted the critical role of broader economic factors in shaping the container logistics market.

“The economic outlook remains cautious, with inflation expectations easing slightly but still weighing on consumer sentiment. Retail and wholesale inventories continue to rise, indicating that businesses are still managing excess stock. This could exert downward pressure on prices, particularly if consumer demand weakens in the coming months,” Roeloffs added.

In the U.S., the trade deficit widened sharply in July to $102.7 billion, its highest level in over two years, signaling ongoing challenges in international trade. The imbalance between flat exports and surging imports could pose future pressures on the U.S. economy, especially if inflationary concerns persist alongside strong consumer demand.

In Asia, manufacturing activity shows tentative signs of recovery, particularly in China, South Korea, and Taiwan. China’s Caixin PMI edging above 50 signals slight growth, but the region’s overall economic momentum remains fragile. “The recovery in Asian manufacturing could boost containerized exports from these regions. However, uncertainties around the U.S. election and potential economic cooling may dampen this growth, creating a volatile environment for container logistics,” Roeloffs observed.

The semiconductor sector continues to be a bright spot in Asia, supported by firm global demand. However, other economies, like Malaysia and Indonesia, are still struggling with the ripple effects of China’s prolonged slowdown. “The upcoming U.S. election could further impact consumer sentiment, leading to fluctuations in import demand. For the logistics industry, this means preparing for potential swings in container volumes, which will require more flexible supply chain strategies,” Roeloffs concluded.

North American supply chains are also bracing for significant disruptions due to potential strikes at Canadian railways and U.S. East and Gulf Coast ports. These disruptions, particularly during peak shipping season, threaten to exacerbate existing challenges within the supply chain.

Leave a Reply